Office Leasing Accelerates Across the U.S.

11/17/21

The recovery in the U.S. office market is firmly underway, with occupiers taking advantage of favorable market conditions to lease space, according to CBRE’s newest Pulse of U.S. Office Demand. Many tenants signed long-term leases, eschewing short-term renewals preferred earlier in the pandemic.

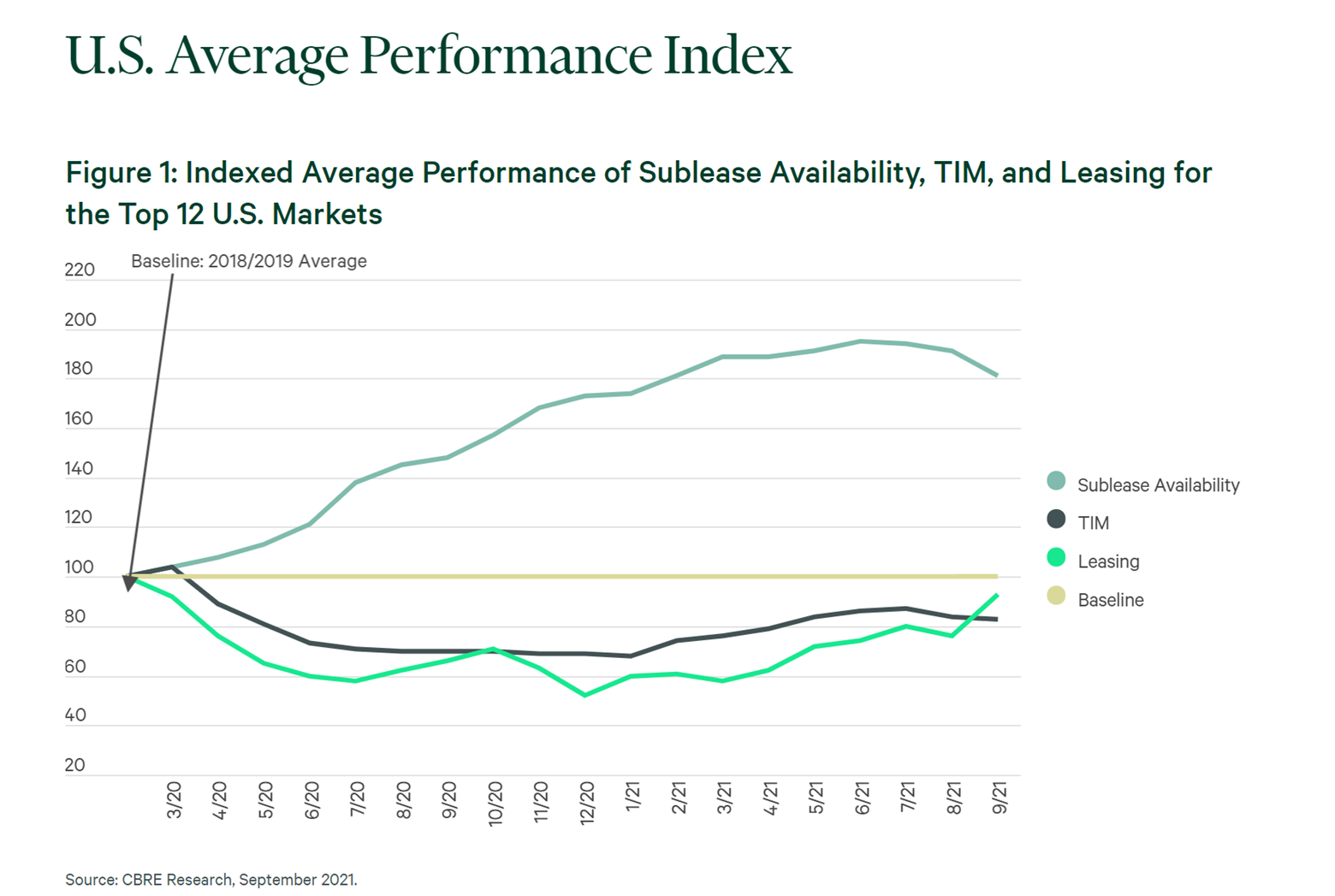

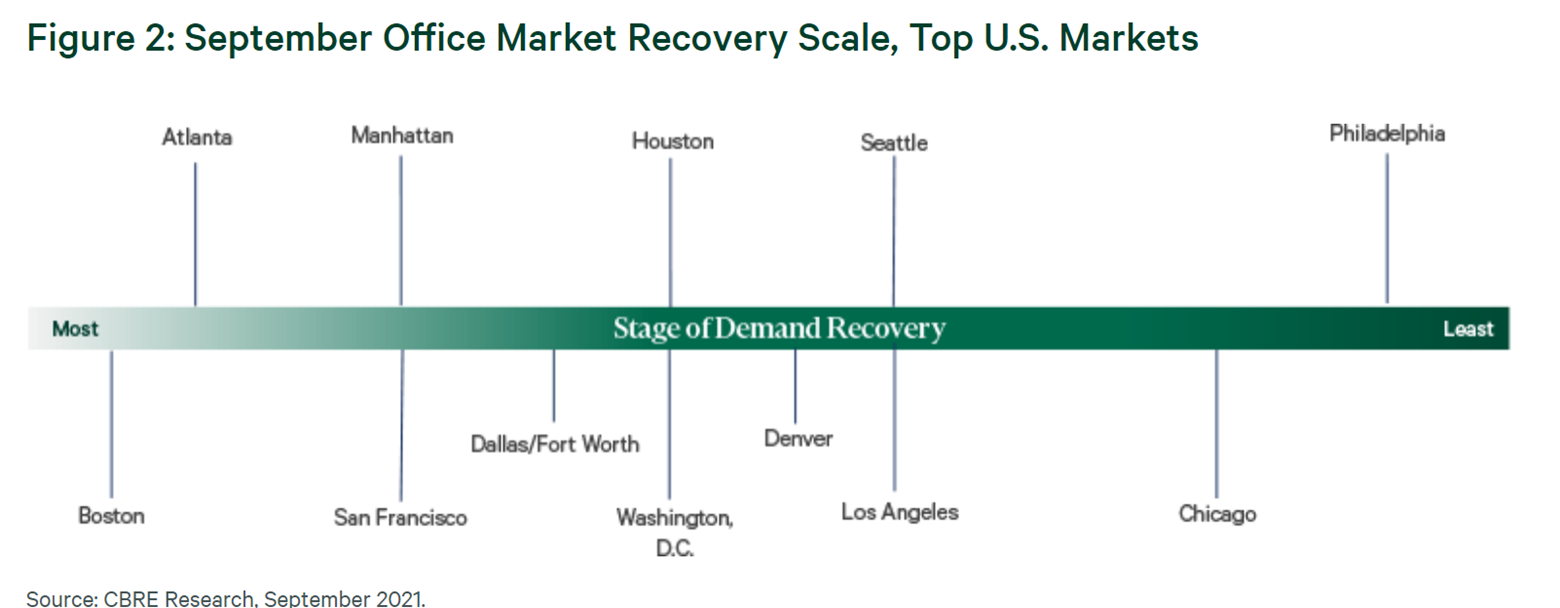

To gauge the pace of recovery, CBRE created three indices for the 12 largest U.S. office markets: Atlanta, Boston, Chicago, Dallas/Fort Worth, Denver, Houston, Los Angeles, Manhattan, Philadelphia, San Francisco, Seattle and Washington, D.C.

Though the U.S. Tenants in the Market (TIM) Index fell by one point in September to 83, CBRE attributes that decrease to many TIM converting to leases. Boston and San Francisco boasted the highest TIM Index levels, both above their pre-COVID baselines.

“Companies are eager to get their employees back in the office,” says Eric Hage, KDC’s executive vice president/development. “They’re moving forward and planning for the future, which bodes well for the office sector.”

Remarkably, the U.S. Leasing Activity Index shot up to 93, a 17-point increase driven by a surge in leasing in Boston, whose index reached an astonishing 210. Excluding Boston, the U.S. Leasing Activity Index gained six points, reaching 82. Nine of the 12 Pulse markets saw their leasing activity indices increase in September.

The U.S. Sublease Availability Index also improved in September, dropping 10 points to 181. The index peaked at 195 in June, and since then, it had been declining slowly. Now, however, the pace of improvement is accelerating, with CBRE attributi

ng the positive movement to occupiers seizing the opportunity to take down well-priced sublease space.

Looking forward, CBRE expects office demand to slowly improve through the end of this year and into 2022.